Blog Archives

The F-Shift Forecaster – an introduction to a powerful market forecasting tool

| T |

he F-Shift Forecaster® utilizes, re-samples and randomizes historical market data to generate high probability outcomes, in a straight forward, un-biased, timely and accurate approach. Simply put – it uses a data mining methodology within an Excel environment, to generate market forecasts without the use of any of today’s plethora of traditional technical indicators and tools. This application was designed and built as a tool within a progressive suite of forecasting tools developed by Fulcrum Shift Advisory which offers a “data mining” specific view or forecast as to future price probabilities regardless of the market.

Bootstrapping is a technique which effectively states that what occurred in the past will in all likelihood; occur again in the future – specifically when dealing in returns

By re-sampling data, in this case, the percentage change from close to close (daily, weekly or monthly depending on the user defined time frame one wishes to trade or forecast) you can make statistical inferences. In plain English, because we are populating the platform with a percentage change as opposed to closing prices or other “price levels”, we can re-use the same historical percentage change data point more than once. We then can make inferences based on the cumulative results of this repeated sampling. Percentage changes from one day to the next, from one week to the next or from one month to the next – regardless of the time frame – are a constant. The actual percentage AMOUNT may vary but unless a closing price is identical to the prior period (day, week, or month) there is always a percentage change in flux and again, price level has no bearing. Here’s why. If a stock were at $100 and it were to drop to $98, a -2% change just occurred (let’s just assume from one day to the next). Lets fast forward now to the end of ’08 during the market crash. That same stock is now trading at $25. The following day the same stock loses only $ .50 but it still represents a -2% change from close to close.

With the addition of a proprietary weighting component, the F-Shift Forecaster can refine these probable outcomes by placing emphasis or an “importance” on the more current data points of our choosing. Weighting probable outcomes is a commonly used practice in most professional sports teams such as football, basketball and hockey.

Each year, amateur athletes enter their drafts hoping to be picked in the 1st round of their respective sports. The teams with the highest probability of getting the coveted 1st pick are the teams with the worst regular season win/loss record. This is an attempt by the league to level the playing field and so it should be. Let’s use the NBA to illustrate this point. The (NBA) recently held their draft lottery with each team having a shot at getting the 1st pick in the 1st round. How do they accomplish this? Each teams name is entered into a drum not unlike the ones used in actual lotteries; however the worst teams (based on their regular season win/loss record) have more names entered into the drum thereby increasing the probability of being selected to have the 1st choice from the upcoming talent pool. The exact numbers of how many names the worst teams have in the drum is not important but the methodology is exactly what has been developed into the F-Shift Forecaster. The worse your teams regular season results were, the more that team has their name in the drum. Although this system of “weighting” doesn’t ALWAYS work, it worked perfectly this year, 2010. The Washington Wizards, who had one of, (if not the worst) regular season record, were randomly awarded the 1st pick overall. Second place went to Philadelphia and third place went to New Jersey. All 3 teams struggled in the regular season with poor win/loss records and because of the weighting approach the NBA uses, it gave these struggling teams the best opportunity to have 1st crack at this year’s star talent. The F- Shift Forecaster works in the identical capacity. What happened recently with respect to price moves and current market volatility is FAR more relevant than what happened say 10 weeks earlier. At the time of this writing, we are in the midst of some incredible market volatility. Daily price swings in both the DOW and NASDAQ are whipsawing even the most seasoned trading veteran. This CURRENT market environment looks nothing like it did a short 6-8 weeks ago. Recent market action is therefore far more relevant than older price action and the ability to model for those dynamics in the F-Shift Forecaster are what really distinguish this tool.

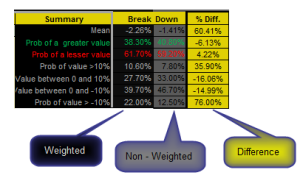

In fact, when modelling probable future outcomes, the forecaster compares weighted forecasts vs. non-weighted forecast results and it is in those comparables results (which would otherwise go unseen), that provide us with our ability to build accurate profiles. When re-sampling data, it is important to understand that we are NOT changing or randomizing the returns themselves but the ORDER of those returns in an attempt to gain a probable and statistical outcome 12 periods in advance. I say periods because as previously mentioned, you can populate the platform with daily, weekly or monthly data which is provided free from Yahoo Finance.

More information and screenshots will follow along with a number of 5 minute web tutorials on exactly how to use this incredibly powerful application This application is part of a suite of other applications all developed in Excel. For any additional information or to have the entire white paper sent to you, you can contact me directly at atlus1432@cogeco.ca or through the links provided via this blog.

Fulcrum Shift Trading

“The ONLY thing in trading you can control is how much you are willing to risk”

Related Articles

- Bartels Sees ‘Correction’ in U.S. Stocks: Technical Analysis (businessweek.com)